7 Predictions for TV & Sport OTT in 2019

What You’ll Learn:

We give our top predictions for the TV & Sport OTT industries in 2019, including the increasingly competitive landscape, streaming service diversification and rapid growth for vMVPDs.

1. The Landscape Will Become More Competitive Than Ever

Memberships to subscription-based media only continued to grow in 2018, with 46% of people now subscribed to the likes of Amazon Prime Video, Hulu, Netflix or Spotify. It therefore stands to reason that 2019’s OTT landscape is looking incredibly competitive already.

The days of being able to subscribe to just Netflix or Amazon and see all the best shows that OTT has to offer are soon to be long gone, with Disney, NBCUniversal, WarnerMedia and Apple all at various stages of preparing their own streaming platforms.

These will all be competing for consumers who will likely have to pick and choose what services they want to subscribe to. There will be super-consumers who subscribe to multiple services, but it’s hard to see that many people will be able to afford to do this, or indeed want to do so, which will intensify the competition to acquire and retain subscribers with exclusive content and offers.

In a pre-emptive strike, Netflix has increased its prices in the US, banking on the appeal of its original content to stop subscribers from churning due to the rises. This is a strategic move before the likes of Disney unveil their offering, claiming a larger share of our wallets ahead of decisions we’ll need to take about whether or not to subscribe to additional new services.

Data from Consumer Technographics shows that only a quarter of people who subscribe to a streaming service have more than one at a time, so for all these new providers, that trend needs to change as 2019 progresses. There are still plenty of factors to play out, including the activity of AT&T, which is increasingly becoming a big player in the OTT market.

“Traditional TV platforms like AT&T and Time Warner and new ones like Hulu and Roku are vying for mass audiences. Acquiring Roku will enable AT&T to take more than half of the typical viewing hours of any household and will give it a hub to monitor viewing characteristics and patterns.”

Collin Colburn, Forrester Analyst

Gaining any kind of advantage in a market as crowded as this will be could be crucial, especially with Netflix already so dominant and Disney having such incredible resources and a vast content library to offer its subscribers. Variety has summed up the complexity of the US OTT market alone here.

2. Mobile Content Consumption on the Rise

A factor that can’t be ignored by any of these streaming giants-in-the-making is the continued growth of mobile as the primary medium to consume content. It’s close to surpassing TV if not quite there already, and content providers are challenged with offering a rich, ever-evolving user experience to keep consumers engaged and optimizing the Customer Lifetime Value.

A report from Ooyala, State of the Broadcast Industry 2019, shows that the average American TV household now has more choices than ever before with millennials increasingly switching from traditional TV to mobile SVOD and even baby boomers are rapidly taking up OTT services. With 5G services set to come into wider usage in 2019, the ease of streaming high-quality video on the go can only benefit providers who get this aspect of their service right.

3. More Strategic Partnerships

While 2019 will see the launch of several new competing streaming services in the OTT marketplace, one trend we expect to see more of is content owners coming together to form strategic partnerships. This year will see the launch of the revamped 7TV in Germany, a joint venture for ProSiebenSat.1 and Discovery Communications that is aiming to reach 10 million subscribers in the first two years and compete with the big global players with a mixture of local and international content.

Meanwhile, in the UK there have been talks between the BBC, Channel 4 and ITV about joining forces to create a British OTT streaming service featuring their content, also in an attempt to offer consumers more homegrown TV.

ProSiebenSat.1’s 7Sports has also recently joined with news platform eSports.com to expand the eSports website with highlights videos, while 7Sports will be establishing its own eSports tournaments and leagues.

The development of strategic partnerships like these within the value chain will enable the personalized, rich experience consumers and fans not only like to have, but expect to have, in 2019.

4. Streaming Services Continue to Diversify

The launch of so many new major OTT players in 2019 is bound to change the landscape in many ways, but one of the most significant – particularly for customers – is the diversification of what we expect from streaming services. WarnerMedia’s upcoming OTT offering is a good example of this, with three different versions due to be released.

So far, major OTT platforms have mostly been of the ‘one size fits all’ variety, not offering packages or bundles in the way that traditional cable or satellite providers have done for some time. A Netflix subscription is a Netflix subscription and the only tiers relate to access and streaming quality.

However, WarnerMedia will offer an entry level service for subscribers who just want movies, while a premium level will include original programming and a third bundle has all of it as well as a wider content library. It will hope that offering these tiers will tempt more subscribers into trying the entry level service before being tempted into upgrading.

5. International Payment Options, Digital Wallets to Improve Ways Customers Pay

As competition hots up in the OTT marketplace, internationalization will become ever more important for providers looking to expand their reach ever wider and stake a claim around the world. NBCUniversal’s SVOD service Hayu launched in Canada and the Benelux region in late 2018 and is expected to continue being rolled-out around the world in 2019.

This presents fresh challenges unique to each new market, not least when it comes to payments, which can differ widely from country to country. To stay competitive, providers need to streamline and improve ways for customers to pay, taking localized payment types should be taken into consideration.

Currently, there are a plethora of online payment methods available. Digital wallets such as Google Pay, Apple Pay, PayPal, etc. provide a safe and flexible way to make a purchase and can result in up to three times better conversion rate from mobile carts.

The Washington Post reported that 70% of people believe that mobile payments will overtake cash and cards by 2030. The rise of new forms of payment is to meet the consumer’s need for a more frictionless checkout experience.

6. vMVPDs to Continue Rapid Growth

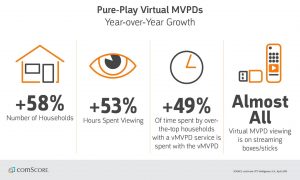

A virtual MVPD a service that offers multiple TV channels via OTT, for example YouTube TV, DirecTV Now and Hulu Live TV. 2018 was a great year for vMVPDs, going from around 4m subscribers to 7.5m and 2019 looks set to continue that growth, potentially even more rapidly.

Streaming via pure-play vMVPDs saw a 58% rise in the number of US households last year, while traditional MVPDs like Dish and DirecTV have either started virtual offerings of their own or have indicated that such services on their way.

With more vMVPDs doing deals with local TV and sports networks, the blurring of the lines is only likely to continue, with subscribers going wherever the best content is available for the best prices, with technology increasingly less of a barrier.

7. Ad-Supported OTT to Continue Booming

While 2019 will see the launch of potentially huge SVOD services, there is still plenty of room in the market for ad-supported OTT, whether that means vMVPDs or the likes of Hulu, Roku or the ad-supported version of NBCU’s upcoming OTT service.

A study by IAB in October showed that 73% of OTT viewers say they watch ad-supported OTT, with 45% saying they mostly watch them rather than SVOD content. With a young, affluent audience and more ability to target and track ads, there’s definitely an appeal for advertisers in this kind of OTT, but that side of the advertising industry is still in its infancy.

The market is certainly there for ad-supported OTT to continue to thrive, especially if the increased competition in the ad-free SVOD market proves to be off-putting for consumers suddenly presented with too many choices and too many subscriptions to pay for.

Get Equipped for 2019 With eSuite, Now Featuring Broadcast Schedules, Customer-Defined Product Bundles & Centralized Subscriber Management

Centralize your digital subscriber management and physical product fulfillment in a single platform with eSuite’s biggest product update, offering opportunities to:

- Launch more granular OTT packages than ever before

- Save time & cost with a single platform to manage ALL subscribers

- Drive new revenue streams with advanced bundling

- Increase engagement with customer-defined bundles

- Target fragmented audiences internationally.

us

us