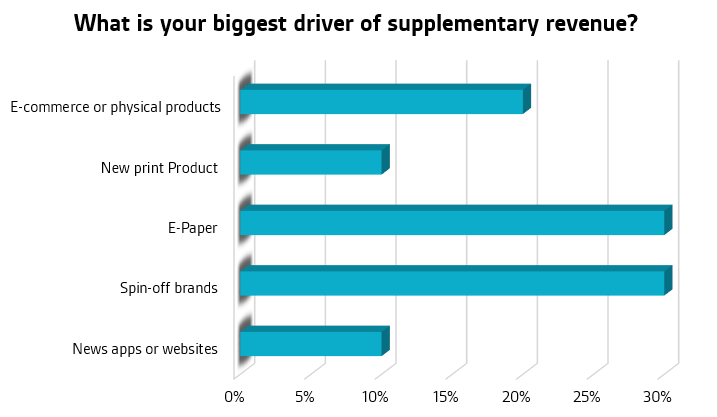

60% of Publishers in NORAM Think E-Papers and Spin-off Products are the Biggest Drivers of Supplementary Revenues

If you missed the webinar, ‘The Product and Pricing Strategies you need to Succeed’, you can now view it on demand.

In their recent webinar, MPP Global and Pagesuite discussed how publishers can develop products that complement existing print and digital subscription models.

The poll question ‘what is your biggest supplementary revenue stream?’ was asked to an audience of publishing professionals across the EMEA and NORAM regions to identify which additional revenue stream was the most popular in an age of declining print and advertising revenues.

Both polls had comparable results with the exception of spin-off brands, which was considered much more important to publishers in NORAM than in EMEA.

NORAM Poll Results Breakdown

The research found that 60% thought e-papers and spin-off brands were their biggest drivers of supplementary revenues. Thus, suggesting that leveraging existing content in repackaged forms is a vital source of additional revenue for publishers.

Over 30% of respondents selected e-papers as their biggest driver of supplementary revenues. This is not surprising given the growth of the e-paper display market, as publishers start to break the mould of the legacy subscription model and leverage audience engagement to create new online experiences that were not previously possible with print. These digital products can be sold alongside print and all-you-can-eat subscriptions and bundled or de-bundled to provide choice.

Spin-off brands

30% of poll respondents voted that spin-off brands were their largest sources of supplementary revenues. During the webinar, Pagesuite and MPP Global provided an overview of some of the most interesting examples of product diversification and spin-off ‘non-news’ products that leading publishers have launched. From the New York Times’s success with their crossword App, to Newsday’s Sports Apps and L’Équipe’s individual article sales; there are many examples of complimentary revenue streams that are already experiencing remarkable success.

EMEA Poll Results

- E-commerce or physical products 19%

- New print Product 16%

- E-Paper 34%

- Spin-off brands 6%

- News apps or websites 25%

The poll results from publishers in EMEA were also similar, with news apps and websites receiving the least votes. Similarly, e-papers were considered the biggest drivers of supplementary revenues coupled with spin-off brands. But there was a shift towards spin-off brands in NORAM as they received 24% more of the vote compared with results from EMEA.

In addition, over 25% of publishers in our EMEA poll said that news apps or websites were their largest supplementary revenue stream. Gone are the days of relying upon a single monetisation model; hybrid pricing models have emerged as a common thread in the market to appease readers who are now craving choice, personalisation and incentives, which apps and websites can facilitate.

19% of publishers in EMEA thought e-commerce or physical products were their biggest source of supplementary revenue, followed by new print products at 16% and spin-off brands at 6%. Publishers are increasingly adopting data driven product strategies to leverage current reader data to build a non-traditional product such as apps or physical products, boost engagement and to tap into newer audiences.

The motivation behind this survey

The webinar looked to explore both traditional and emerging revenue streams. There have been several studies and articles showcasing how products are being repackaged or tailored toward specific devices or consumer behaviour. The results of these polls are similarly indicative that most publishers consider the repackaging of existing content and tailoring towards specific devices and consumer behaviour are a major source of supplementary revenues.

Elsewhere, to generate uptake, brands are leveraging current reader data to build a non-traditional product, such as apps or physical products, to either boost engagement, open up revenue streams or tap into newer audiences.

Operational speed, agility and flexibility are key to success in this fast-moving space. Most publishers have a wealth of content but lack the ability to package, re-purpose and sell quickly.

The future of supplementary revenues

The key to the future of supplementary revenues lies in innovation, diversification and breaking the traditional subscription mould. It is clear that MPP Global’s research indicated that all supplementary revenue streams are important and e-papers are certainly a must have investment for publishers’ supplementary revenues.

VP of Media and Publishing at MPP Global, Ana Lobb, stresses the importance of extending product packaging and offering a diversified portfolio of products to suit all demographics: “certainly one size does not fit all.” Publishers must listen to their readers and “ask, test, refine”.

Lobb also advocates a complementary strategy that supports print and digital by bundling, which helps publishers to “become operationally very efficient and launch quick to market spin-off products”.

According to PageSuite’s Business Development Director, Ben Edwards, publishers must select tools that empower sales, marketing and product teams to innovate to make data actionable. “Our key initiative is the innovation launch pilot” says Ben: “try to work with a partner or an internal team to create something, get it to market quickly then refine and test it.”

us

us