Retention & Recovery

Maximise Recurring Revenues & Minimise Churn

Retain, Optimise & Predict

Reduce Involuntary Churn by More Than 90%

Significantly reduce involuntary churn and maximise recurring revenues with retry rules, card updater services & payment windows

Save >30% Of Customers Annually With Optimised Billing

Fine-tune recurring transactions to boost approval rates globally through optimised billing and payment routing

Boost Subscriber Retention & Win-back Rates

Proactively retain and win-back subscribers using personalised cancellation flows and marketing campaigns to incentivise & reward

Accurately Predict Up to 90% of Churning Customers

Gain insight into customers most at risk of churn and target with a range of communications and offers to increase ARPU & minimise churn

Reduce Involuntary Churn by More Than 90%

An estimated ~30% of churn is attributed to involuntary, unwanted churn and revenue loss. eSuite’s churn prevention capabilities can drastically reduce involuntary churn rates to less than 2%, with a range of tools to maximise transaction success & stabilise your bottom line.

- Account Updater Services (Visa & Mastercard) – Minimise loss of business due to subscriber payment details becoming outdated or replaced.

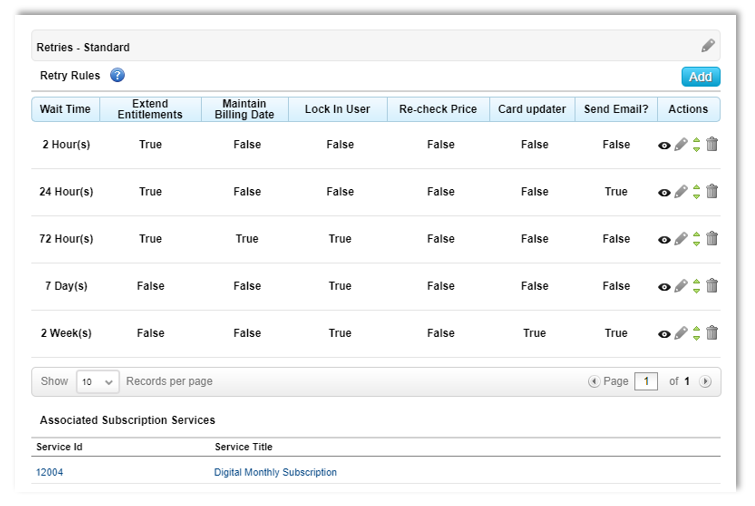

- Intelligent Retry Rules – Maximise subscriber lifetime value by crafting highly configurable retry attempts for failed payments over a prolonged period.

- Payment Windows – Increase transaction approval rates by more than 50% by presenting renewal payments at optimal days and times on a per-country basis.

Save >30% Of Customers Annually With Optimised Billing

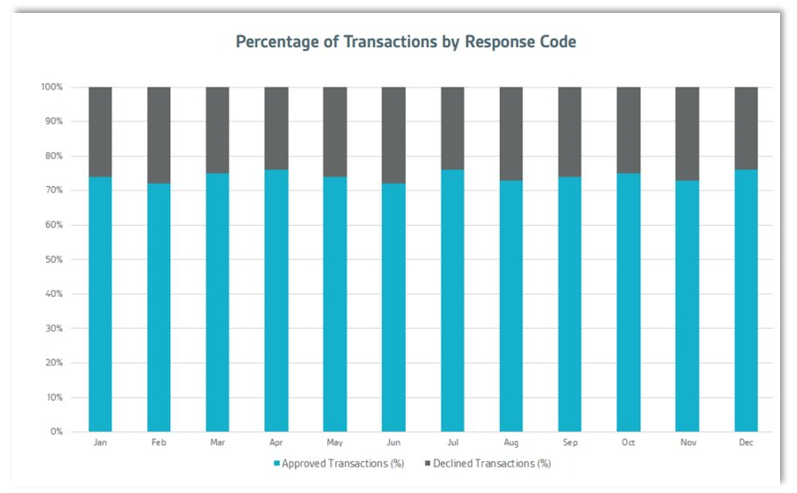

There are commercial benefits to fine-tuning recurring transactions and optimising the billing process. In doing so, companies can boost approval rates on a global scale and minimise risk of involuntary churn.

- Pre-authorisation Transactions – Gain insight pre-renewal on whether a payment is likely to succeed, offering a window of opportunity to communicate and update card details.

- Payment Routing – Process transactions through local acquirers to increase payment success and reduce cross-border transaction fees.

- Card on File & Transaction Flagging – Increase renewal rates by storing authorised payment details for repeat purchases, and append flags to indicate recurring transactions.

Boost Subscriber Retention & Win-back Rates

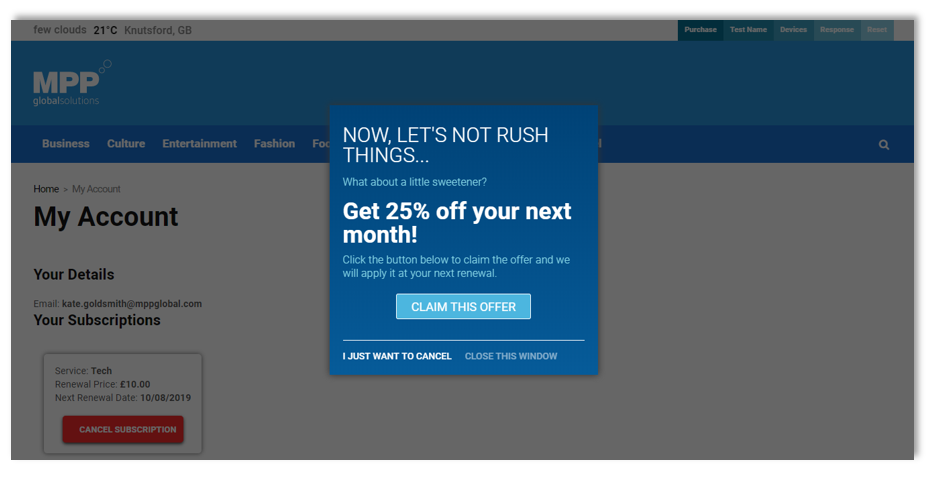

There are some subscribers who will actively decide to cancel their subscription due to concerns surrounding price, experience or quality. eSuite offers various retention solutions to retain subscribers on the verge of leaving and to win-back any lost custom.

- Offers & Discounts – Optimise cancellation flows by serving up various personalised promotions.

- Switch Packages – Enable subscribers to upgrade, downgrade or switch to a more suitable package or payment method.

- Pause Subscriptions – Temporarily pause payments and entitlements for subscribers with financial concerns.

- Win-back Campaigns – Build & deploy highly personalised product packages and promotions to incentivise customers to return.

Accurately Predict Up to 90% of Churning Customers

Identifying subscribers most at risk of churn enables media companies to target them with effective retention strategies and tailored communications before they have the chance to leave.

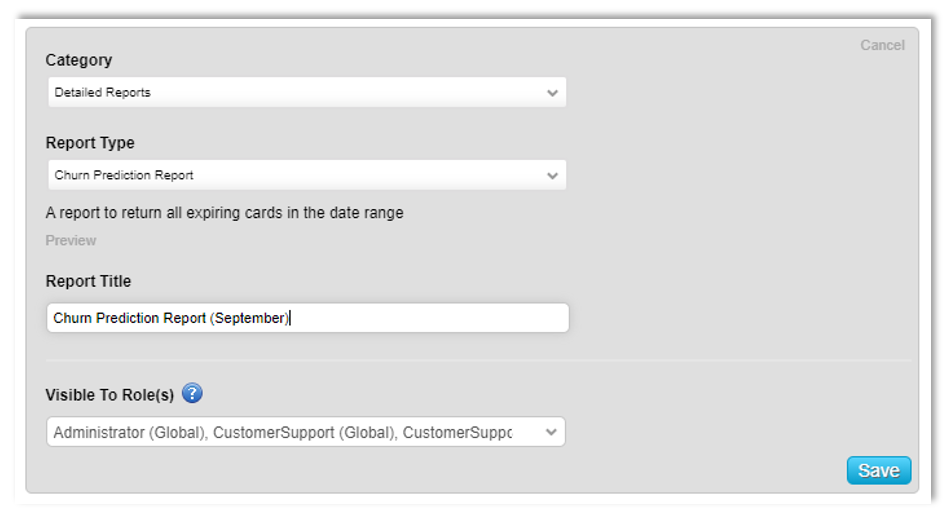

eSuite utilises machine learning to generate predictive churn algorithms to analyse a series of systematic data points, accurately identifying up to 90% of subscribers most at risk of churn. This incredible insight into subscriber data is provided to companies as a monthly report of those subscribers who are likely to churn, enabling you to act decisively and target effectively, while also better informing finance teams with revenue predictions.

Explore More Modules

Everything You Need to Develop a Successful Paid Content Strategy

See how we helped

'Racing Post'

Publishers are taking note of the changes to the industry as print plateaus, with 27% of publishers planning to invest most heavily in digital memberships and paywalls in 2017. Racing Post, the UK and...

This project enables Racing Post to make that next step towards truly innovative digital service strategies. Leveraging eSuite, Racing Post can better understand who our customers are and their usage habits, have the necessary tools to increase acquisition and most importantly reduce churn.

” us

us